9 Easy Facts About "Is Earthquake Insurance Worth the Investment for Seattle Homeowners? Here's What Experts Say" Shown

If you live in Seattle or anywhere else in the Pacific Northwest, you recognize that quakes are an ever-present risk. While much smaller agitations may be nothing more than a minor hassle, bigger quakes may cause notable damage to your residence and personal belongings. That's why it's vital to look at quake insurance policy as component of your total individual's insurance policy plan.

In this short article, we'll discover why quake insurance coverage is essential for Seattle citizens and what it can carry out to protect your property and financial resources.

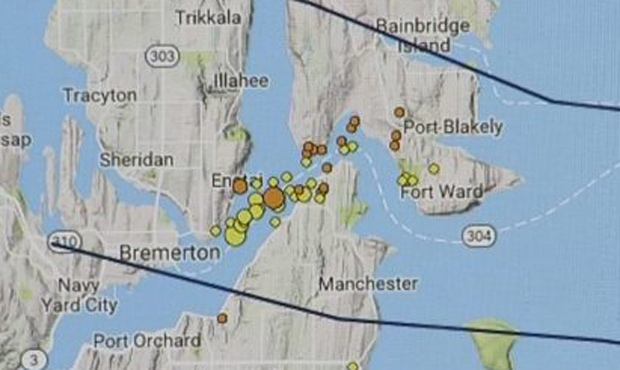

The Risks of Living in Seattle

Seattle sits within the Cascadia Subduction Zone, a region where two tectonic platter comply with and assemble. This region is known for its "quiet earthquakes," which occur deep underground and can lead to much much larger tremors on the surface. In Washington Flood & Quake Insurance , specialists predict that there is a one-in-three opportunity of a primary earthquake (magnitude 8 or higher) occurring in the Pacific Northwest within the next 50 years.

A major quake might ruin Seattle and its encompassing places. The shaking alone might lead to considerable damage to buildings, roads, and other framework. In addition, there is actually the danger of landslides, liquefaction (when ground switches into fluid), and tidal wave triggered through undersea landslides or excitable task.

Shielding Your Home with Earthquake Insurance

Quake insurance policy delivers insurance coverage for harm led to by seismic task. Unlike common property owner's insurance policy policies, which normally exclude earthquakes from protection, earthquake insurance particularly deals with reductions related to ground movement such as drinking or sinking.

Without quake insurance policy coverage, you would be responsible for mending any type of damage created through an earthquake out-of-pocket. This could possibly possibly bankrupt many individuals if they were struck with extensive damages from an quake.

Quake insurance coverage policies cover a vast selection of damages that may occur throughout an event such as:

- Structural Damages: Harm caused through trembling includes splits in walls or structures.

- Personal Property Damage: Quakes may topple home furniture, appliances and other things in your house.

- Extra Living Expenses: If your house is uninhabitable after an earthquake, this coverage might help you pay for momentary housing and other expenses until you can return home.

- Landslide Damage: Earthquakes can induce grand slams that may damage your building. Quake insurance policy may cover the expense of fixings or replacement.

It's necessary to keep in mind that earthquake insurance coverage plans normally have a different deductible from your common property owner's insurance plan. This deductible is commonly a percentage of the insured value of the property, which implies it can be considerably much higher than what you would pay for for other styles of insurance claim.

Why You Need to Take into consideration Earthquake Insurance

While Seattle residents are no unfamiliar people to earthquakes, several have not taken the actions required to protect their houses and funds against them. Here are three factors why you should consider incorporating earthquake insurance coverage to your home owner's plan:

1. It Gives Peace of Mind

Understanding that you're covered in the activity of an quake can easily provide notable calmness of mind. You'll be able to rest easy knowing that if a major quake were to develop, you wouldn't be left along with considerable out-of-pocket expenditures.

2. It Might Conserve You Money in the Long Run

While purchasing quake insurance does happen at a expense, it might conserve you amount of money in the lengthy run if an earthquake were to develop. The cost of mending architectural damage or substituting private residential or commercial property could far surpass what you would pay for an annual costs.

3. It's Much better to Be Risk-free Than Sorry

Earthquakes are uncertain and can hit at any time along with little bit of warning. Having quake insurance coverage protection suggests that you're well prepared for whatever happens your method.

Conclusion

Living in Seattle implies residing along with the steady risk of earthquakes. While it's inconceivable to forecast when or where they will hit, it is feasible to secure yourself fiscally through investing in quake insurance policy protection.

By performing therefore, you'll possess tranquility of mind recognizing that if the worst were to occur, you and your loved ones won't be left with the monetary problem of mending harm led to by an earthquake. Therefore when looking at your house owner's insurance policy, make certain to add earthquake insurance coverage to ensure that you're completely safeguarded.